|

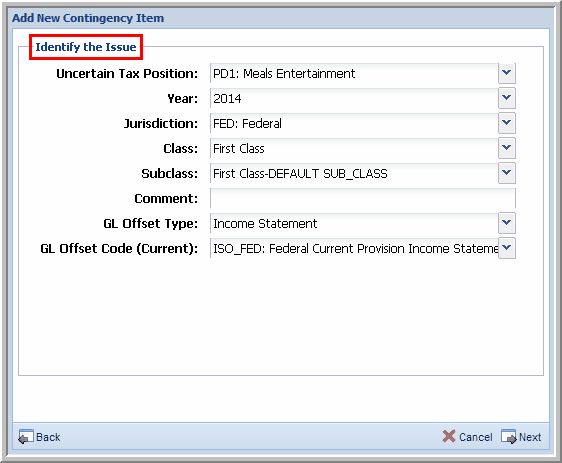

To identify a position:

| 1. | In the Uncertain Tax Position drop-down list, select the Position Code + Description. |

| 2. | In the Year drop-down list, select the Year in which the issue appeared. |

| 3. | In the Jurisdiction drop-down list, select the Jurisdiction for the position. This selection also determines the information required during the workflow. |

| • | The country assigned to the unit in determines the Federal/National jurisdiction option available, for example, United States - Federal; Canada - Canada; United Kingdom - Great Britain; Other (including Undetermined) - National. |

| 4. | In the Class drop-down list, select a Class. The classes available are set up in the Admin Center. It is recommended that you use classes as a way to create duplicate positions. This selection has no impact on any calculations or reports. Once a class is assigned to a position, you cannot change the assignment. |

| 5. | In the Subclass drop-down list, select a Subclass. The subclasses available are set up in the Admin Center and associated to a Class. A subclass can be changed unless the position is finalized. |

| 6. | Type a Comment. You can have up to 30 characters for the comment. Point your cursor to the highlighted comment in the positions table the comment information appears. If no comment exists, the comment is unavailable. |

| 7. | In the GL Offset Type, select Income Statement, Equity, or Non-Cash for the GL offset. For more information about this selection, refer to the Non-Cash and Equity section. |

| 8. | In the GL Offset Code (Current), select a GL Offset Code. This selection provides you the ability to describe where on the Balance Sheet the impact is recognized. For more information, refer to the Tax Provision Impact section. |

| 9. | If you select Temporary Difference as the Type of Position, select Current or Non-Current for the Deferred Category. |

| 10. | Click Next to continue the workflow. |

Identify the Issue

|