|

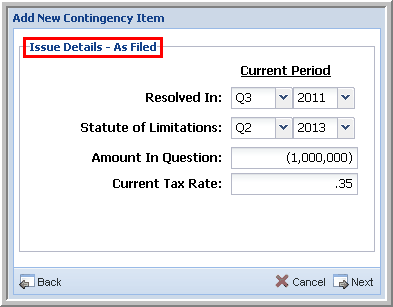

To enter information for the Amount in Question (AIQ):

| 1. | In the Resolved in drop-down list, select the Resolved In quarter and year. The resolved-in quarter and year information is required. This information determines whether the related Taxes Payable is classified as current or non-current. The Uncertain Tax Positions Application compares the dataset year with the resolved-in year. If the difference is 12 months or less, the Taxes Payable are current. |

| • | Select N/A for the Resolved in year, if appropriate. Positions with a Resolved in year of N/A appear as non-current in the Payable Report and in the Payable sections of the Journal Entry Report. |

| 2. | In the Statute of Limitations drop-down list, select the Statute of Limitations quarter and year. |

| • | Select N/A for the Statute of Limitations Year, if appropriate. |

| 3. | Enter the Amount In Question as a negative number if the amount was a decrease to taxable income when it was originally taken in the return/provision. |

| 4. | Enter the requested rates. Depending on the Type of Issue and the Jurisdiction you have selected, different tax rate fields appear. The rates you enter in the "Issue Details - As Filed" dialog box default to the Issue Details - Unrecognized Position dialog box. |

| 5. | Click Next to continue the workflow. |

Issue Details - As Filed

|