|

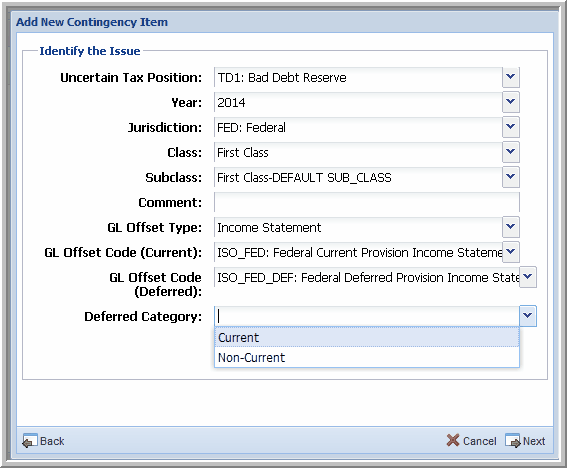

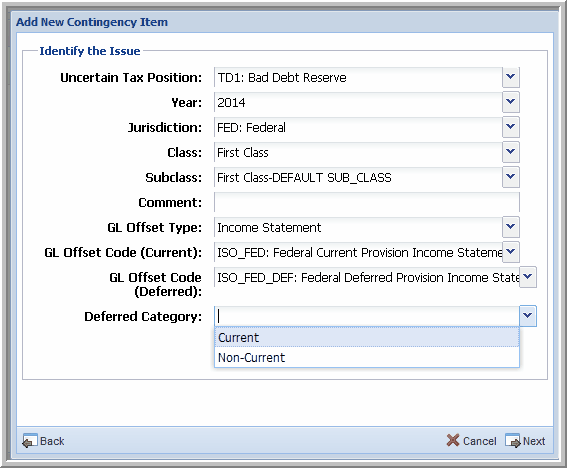

To identify a temporary position as non-cash or equity, select Income Statement, Equity, or Non-Cash from the GL Offset drop-down list. For all temporary differences, you must also select a Deferred Category for the position: Current or Non-Current. This category appears in the Deferred report, regardless of whether Equity or Non-Cash is selected.

| • | Positions selected as Non-Cash appear as Non-Current in the Payable and Journal Entry reports. |

| • | Positions selected as Income Statement or Equity appear as Current or Non-Current, depending on the Resolved Quarter/Year and Dataset Period/Year. |

| • | You can select a GL Offset Code for Income Statement, Equity and Non-cash positions. You can use the Offset Code to indicate which balance sheet account the uncertain tax position posts to in the Impact to Tax Provision report. In a future release, you can use the GL Offset Code to transfer data to ONESOURCE Tax Provision. |

Add New Contingency Item - Temporary

After a position is rolled over, you have the option to change the Equity/Non-Cash option.

| • | Positions cannot be changed from EQ to NCS or from NCS to EQ. |

| • | The Calculation Support Schedule, as well as the Uncertain Journal Entry and Uncertain Expense reports, show the reclassification of amounts. |

| • | For more information about this, please refer to the NCS/EQ Explanation guide in My UTP page. |

|