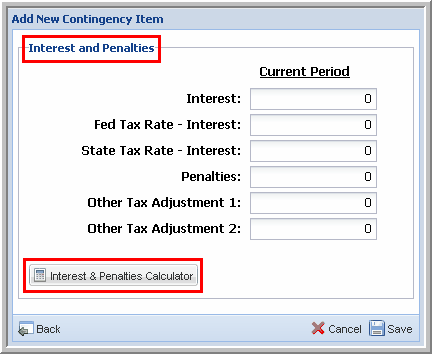

Interest and Penalties

|

You can calculate Interest and Penalties by using the "TimeValue's TaxInterest" program embedded in the Uncertain Tax Positions Application. You can calculate Interest for both payments and refunds. You can also calculate Interest and Penalties offline and then enter that information into the final data entry page. Note: Interest rate tables are provided and updated by TimeValue on a quarterly basis. If you have any questions about the TimeValue interest tables, please contact them directly at (800-426-4741).

To calculate your interest and penalties, click the Interest & Penalties Calculator button to use TimeValue TaxInterest. Interest & Penalties Calculator

After calculating your interest and penalties, you will return to the Add New Contingency Item page. The View Report button appears to view the Interest & Penalties Schedule for the position. If you follow a "Below the Line" treatment of interest, you must enter the rates for interest to ensure the benefit is correctly calculated.

|