Uncertain Journal Entry

|

Show

Note: The Accrued Interest and Penalties section will show interest and penalties for positions when in the above views.

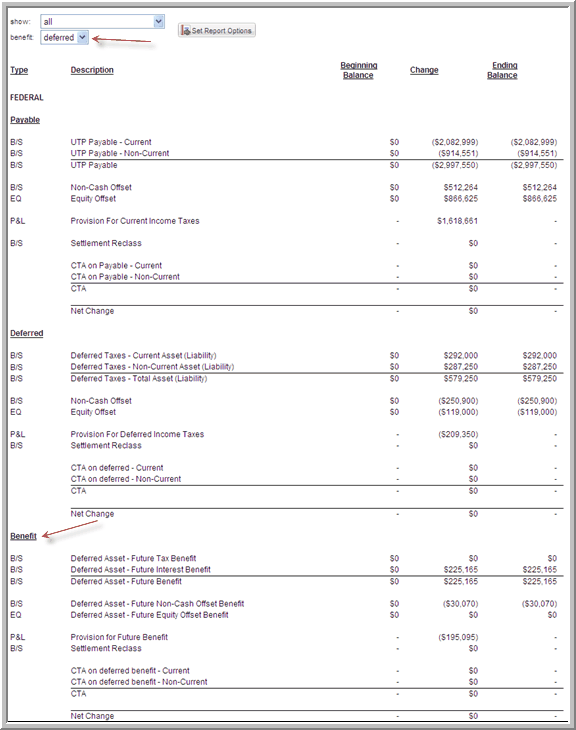

Benefit Select current or deferred in the benefit drop-down list in the Uncertain Journal Entry report to view the report in either current or deferred reporting. The report shows the future benefit with current or as deferred where the future benefit is broken out in a separate Benefit section in the report.

When you select deferred, three additional lists appear:

The Benefit section of the report lists the amount of the benefit in detail.

Uncertain Journal Entry Report

|