|

Domestic States, Canadian Provinces, and Defined/ Entered Custom Jurisdictions

To add State and Custom Jurisdictions, click the Interest & Penalties Calculator button in the Interest and Penalties dialog box.

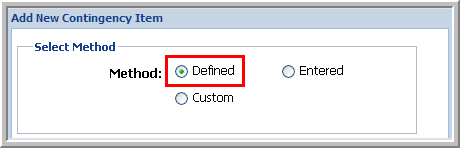

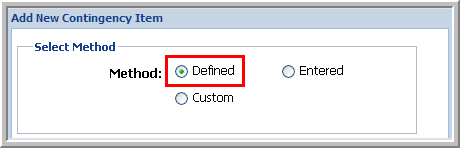

| 1. | Click the Defined option to calculate Interest and Penalties for a US State or Canadian Province. In general, rates in the application are maintained by TimeValue. |

| • | If you have a rate which is not maintained by TimeValue, the application defaults to the unit rates indicated for the country. |

Defined Interest Calculations

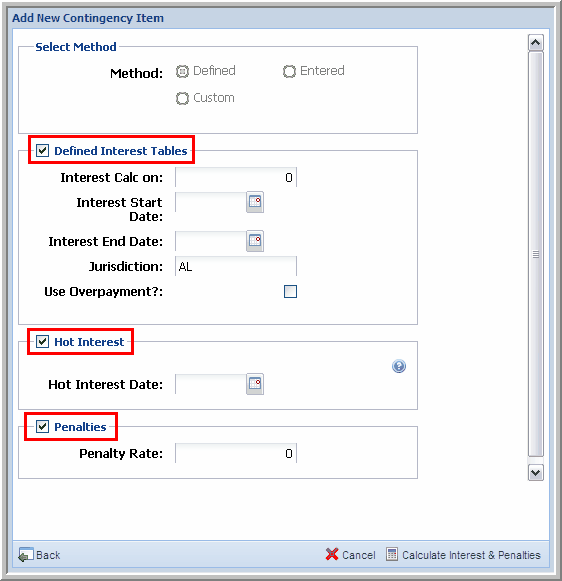

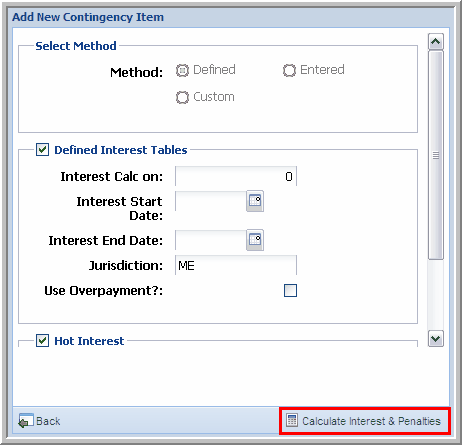

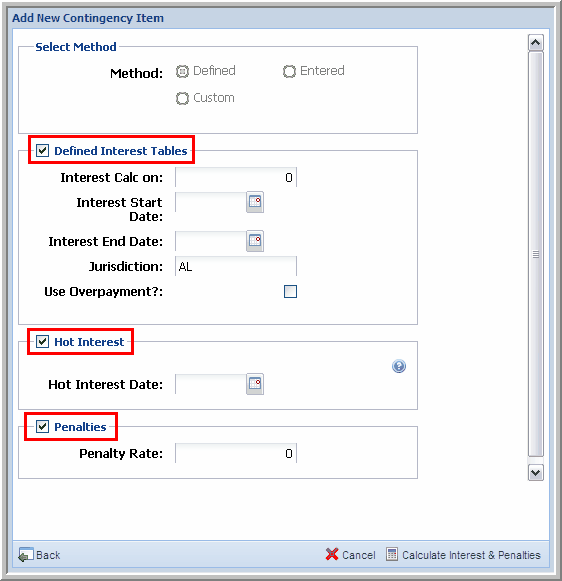

| 2. | Select the check boxes for the Defined Interest Tables, Hot Interest, and Penalties to enter the data to calculate. |

Defined Interest Tables, Hot Interest, and Penalties

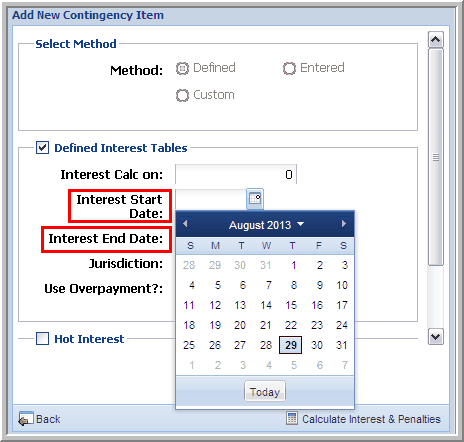

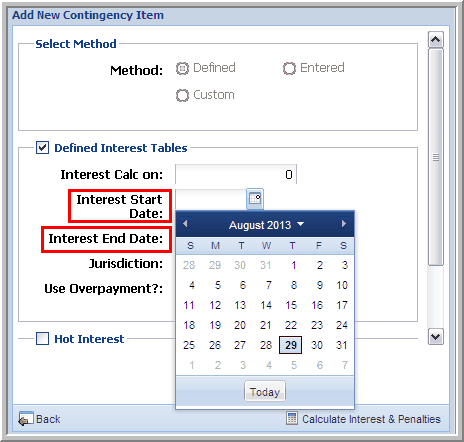

| 3. | Type the Interest Start Date and End Date. You can select the Calendar and click the date to ensure the date is in the correct format (MM/DD/YYYY). |

Interest Start Date and Interest End Date

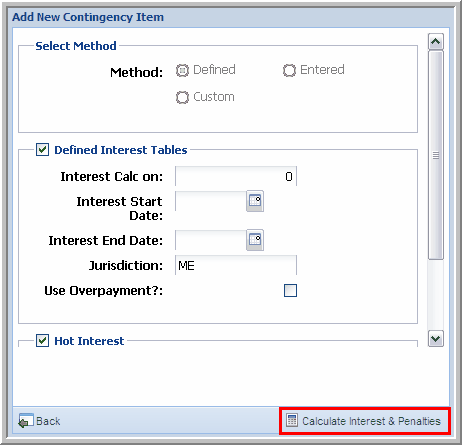

| 4. | Click Calculate Interest & Penalties. The previous data entry will appear with your interest and penalties amounts. |

Calculate Interest & Penalties

Note:

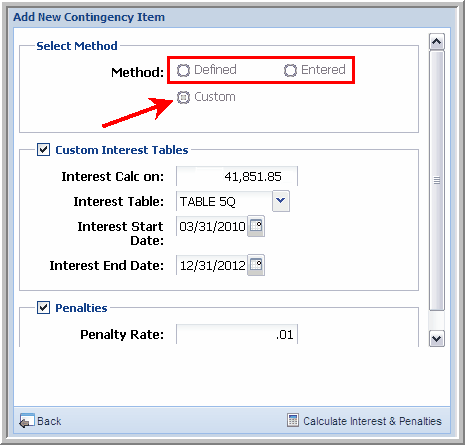

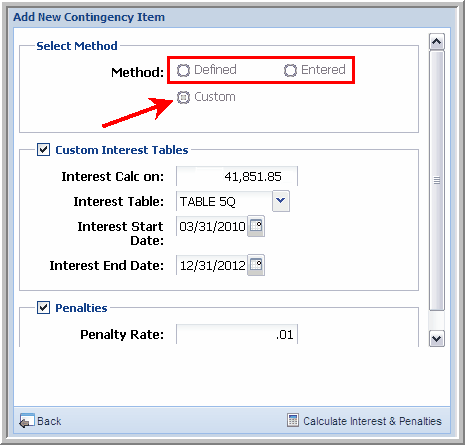

| • | After you select the Defined Interest Tables, Entered Interest Rates, or Custom Interest Tables, the other options are unavailable. If you select the incorrect option, uncheck the box and the options are available. |

Select a Method - Other options are unavailable

|