|

You can choose the Defined option to calculate interest annually with daily compounding, using a year with 366 days. In order to use a year with 365 days (366 days for a leap year), add two days to the start date and one day to the end date. For example, to accrue for every day for two full years (1/1/2013 through 12/31/2014), input a start date of 12/30/2012 and an end date of 1/1/2015.

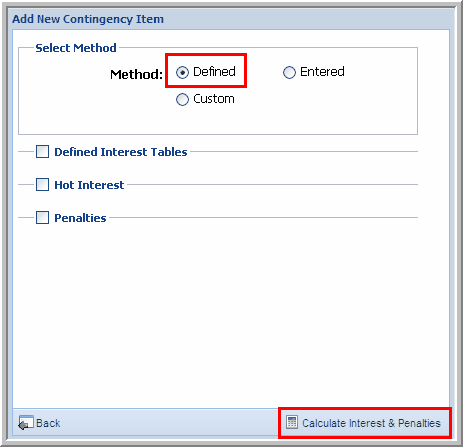

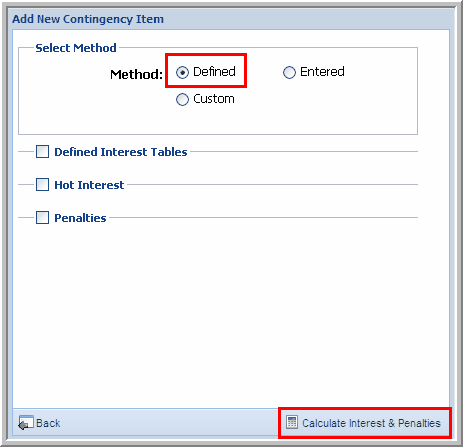

| 1. | Select Defined to calculate Interest and Penalties for the Domestic Federal jurisdiction, Canadian, or United Kingdom (GBR) jurisdictions that are pre-defined in the system. |

| 2. | Select the check boxes for the Defined Interest Tables, Hot Interest, and Penalties to enter the data to calculate. |

| 3. | Select the Calendar and click the date to ensure the date is in the correct format (MM/DD/YYYY). |

| 4. | Click Calculate Interest & Penalties. You will return to the previous data entry page now showing your interest and penalties amounts. |

Defined Interest Calculations

Note:

| • | After you select Defined, Entered, or Custom the other radio buttons are unavailable. If you accidentally choose the wrong designation, click the option selected to clear the Defined or Entered Interest so both options are available. |

U.S. Federal Penalties

| • | Penalty 6662: Substantial understatement of income tax. |

| • | Penalty 6651: Failure to file return when due. |

All U.S. States Interest Table

Canada

Canadian Provinces

United Kingdom Interest Table

| • | Available start dates for the UK (GBR) interest table currently start on March 6, 1993. Entering a date before 03/06/1993 will return an interest amount of zero. |

Australia Interest Table

New Zealand Interest Table

Venezuela Interest Table

| • | Available start dates for the VEN (VE) interest table currently start on November, 1995. Entering a date before November 1995 will return an interest amount of zero. |

Brazil Interest Table

Ireland Interest Table

Note: Refer to the Custom Rate Tables section for information about the Entered designation.

|