|

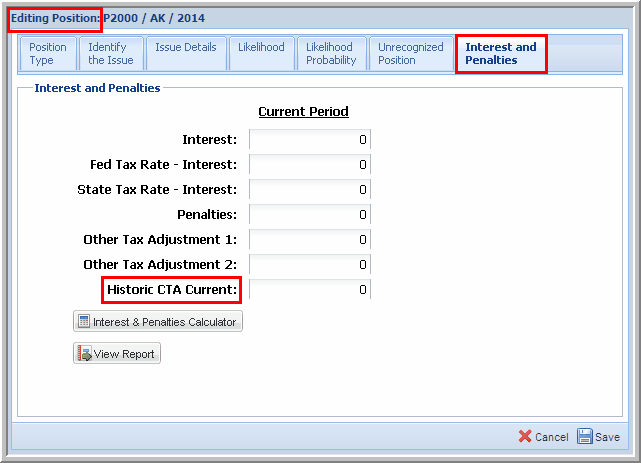

You can manually enter the Historic CTA balances to capture the Historic CTA that you calculate offline. Then, you can track the currency gain and loss for a position over a period of time.

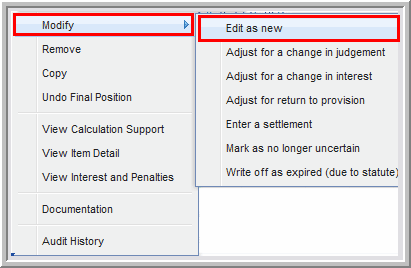

| 1. | In Positions, select a position by clicking a Position's Code (blue hyperlink) and the Position's menu appears. |

| 2. | Then, select Modify and Edit as new. |

Modify - Edit as new

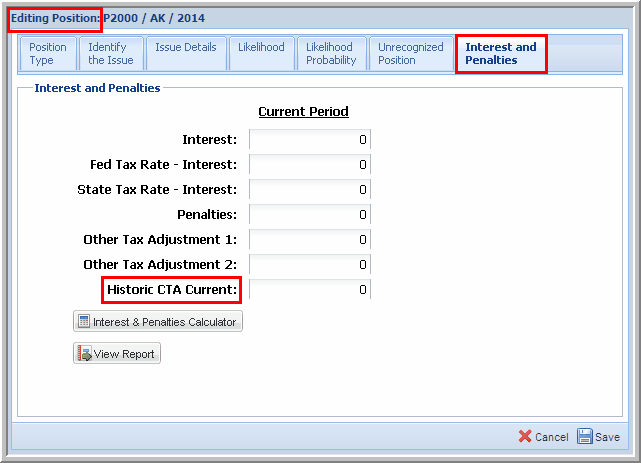

| 2. | In Editing Positions, select the Interest and Penalties tab and then enter the Historic CTA Current amount. Note that the application can also calculate this Historic CTA for you. In Action Items, you can select Update Cumulative Historic CTA and then click Go. |

Interest and Penalties - Historic CTA Current

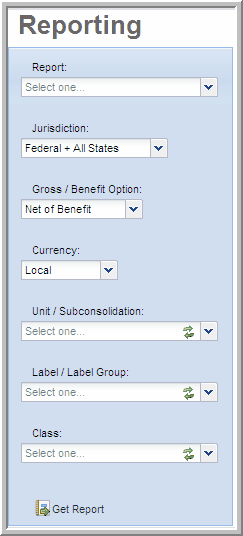

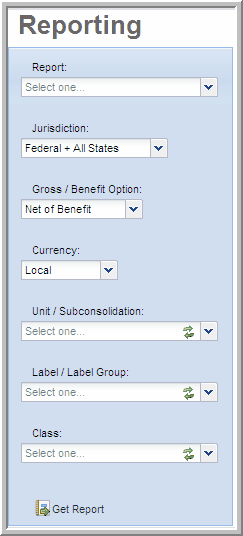

In Reporting, you can select the view that supports the Historic CTA amount.

| 1. | Select the Uncertain Deferred Rollforward or Uncertain Payable Rollforward Report. |

| 2. | Select the Jurisdiction, Gross/Benefit Option, Unit/Subconsolidation, Label/Label Group and Class. |

| 3. | Select Reporting for the Currency. |

| 5. | Select the report options, view Historic CTA, group by, show, and detail. |

| 6. | Click Set Report Options. |

| 7. | The reports appear with the Unit Code, Year, Country, Jurisdiction, Type, Uncertain Item, Status, C/NC, CTA Beg Balance, CTA Change, and Total CTA. |

Reporting Historic CTA

|