|

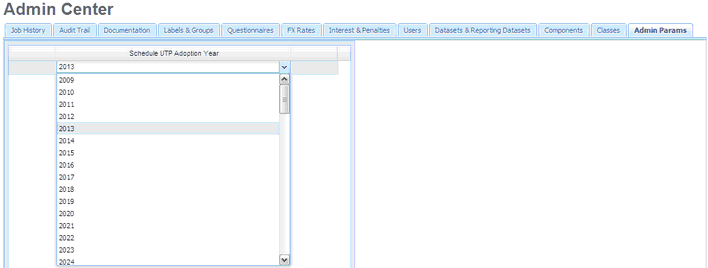

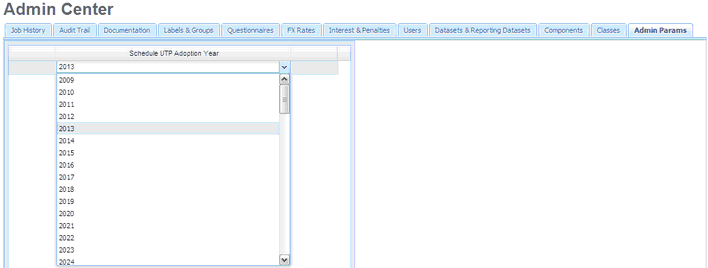

In the Admin Center, Admin Params tab, you can assign the first year to appear in the Schedule UTP report; then, maintain the "Schedule UTP Adoption Year." The Schedule UTP Adoption Year dictates when you must start disclosing your uncertain tax positions.

| • | It is set up in order to follow specific IRS Schedule UTP disclosure rules that are generally based on a company’s total asset value. For companies with over 25 million in assets, the year was 2010 and the threshold goes down for the asset size that is required to disclose. |

| • | The year that is set in Admin Params dictates the "earliest year" filter for positions in the Schedule UTP report. The Schedule UTP Adoption Year drop-down list enables you to choose a year in order to follow the IRS Schedule UTP disclosure rules. |

| • | The Admin Params enables flexibility for fiscal year end reporting. |

To change the Schedule UTP Adoption Year:

| 1. | Double-click the year in Schedule UTP Adoption Year. |

| 2. | Select the required year from the available years in the "Schedule UTP Adoption Year" drop-down list. |

|