Additional Information

|

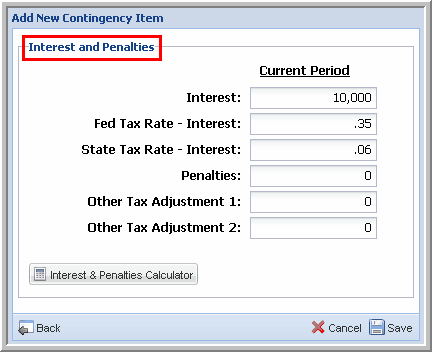

To enter additional information for the Uncertain Tax Position:

Interest and Penalties Interest and Penalties can be calculated offline or by using TimeValue TaxInterest. For more information, refer to the Interest and Penalties section. If you follow a Below the Line treatment of interest and penalties, enter the Federal, and State Tax Rates for the interest amounts to ensure that the benefit is calculated correctly.

Hot Interest Hot Interest is essentially a 2% penalty added to the rate for a specified time period.

Other Tax Adjustments For instance, if the issue provides for recognition of income and the offsetting tax credit is associated with recognizing that income, the credit is entered here.

Interest and Penalties

|