Schedule UTP Report

|

This report is based on the definition IRS sent out. IRS requires you to show the maximum tax exposure. The Schedule UTP provides you a way to rank your positions. You could show only one if that is all that is needed. The report discloses only words and rankings. The IRS made this requirement for those with a Balance Sheet over 100 million for the first year and only have to disclose positions that arose in 2010 and going forward. You can run these for a label or label group.

Schedule UTP Report In Reporting, select the Report, Schedule UTP Report, Jurisdiction, Gross / Benefit Option, Currency, Unit /Sub-Consolidation, and Label / Label Group. Click Get Report.

The report will show:

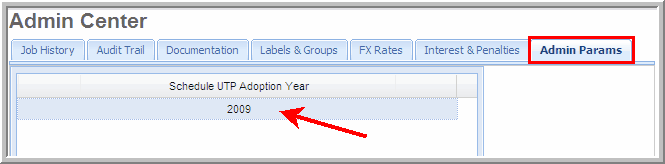

To change the year end date:

Admin Params - Schedule UTP Report Year End Date

Notes:

|