|

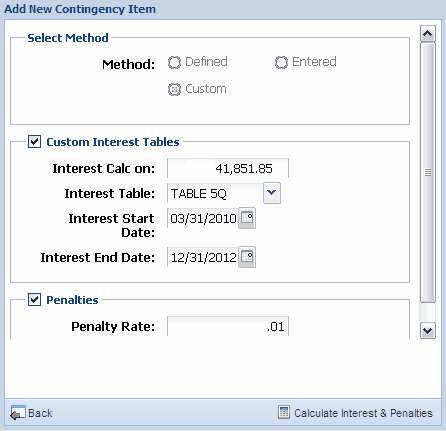

To calculate interest and/or penalties:

| 1. | Select Custom to calculate Interest and Penalties for an Entered Federal jurisdiction or a Custom Jurisdiction (a custom state or an entered jurisdiction other than Canada or United Kingdom). Because these custom jurisdictions do not have a rate table in TimeValue's TaxInterest, you can build your own rate table for the position and select the type of compounding (Daily, Monthly, Quarterly or Simple) for computing interest. |

| 2. | Select the check boxes for the area(s) you want to calculate. |

| 3. | Use the Calendar feature to select dates to ensure the entry of dates are in the correct format (MM/DD/YYYY). Click Calculate Interest & Penalties. Once the calculation is complete, the previous data entry page appears with the interest and/or penalties amounts. |

Custom Method

To build a custom rate table in the import file:

| 1. | Enter the start and end dates and applicable rate for the period. Only valid rates are accepted: |

| • | Rates can be imported/exported in the Interest & Penalties area of the Admin Center. |

| • | Rates are available in .25% increments from 1% up to 25%. |

| • | Rates are available in .50% increments from 25% up to 100%. |

| • | The start date is one day after the end date from the previous line and cannot be modified. |

| • | The rate table can have multiple rates. |

| • | You can create a custom rate table profile. For example, if you create one for Germany you can apply Germany to one or more positions. |

Note:

| • | In versions prior to 5.0, you can enter up to five rows of rates. Now, you can create a table with unlimited rows and reference these tables when calculating interest. |

| • | To remove the last row from the rate table click the X. Only the last line in the rate table can be removed. |

|